In the turbulent sea of financial markets, history serves as both our mentor and our compass. Stock market crashes, those cataclysmic events etched in the annals of finance, have offered profound lessons to those who dare to navigate these treacherous waters. Join me on a journey through time, where I unravel the riveting stories of significant market crashes. From the Great Depression’s crippling blow to the dot-com bubble’s burst, each crisis carries its unique lessons. As I delve into the causes, consequences, and recoveries, you’ll discover that these historical tempests can illuminate the path to prudent investing.

Introduction to Stock Market Crashes

Stock market crashes are pivotal events in the financial world. They are characterized by a sudden and severe decline in the prices of stocks and securities traded on stock exchanges. These crashes hold significant importance due to their far-reaching impact on investors, economies, and global financial stability.

Key insights:

- Nature of Stock Market Crashes: Stock market crashes are rapid and substantial declines in stock prices, often resulting from a variety of factors such as economic downturns, investor panic, or external shocks.

- Significance: These events can trigger economic recessions, financial crises, and widespread loss of wealth. Understanding the significance of market crashes is crucial for investors and policymakers.

- Impact on Investors: Stock market crashes can lead to substantial losses for investors. Those who fail to prepare or respond to such events can suffer financial setbacks, while those who navigate them wisely may find opportunities.

- Historical Context: Throughout history, stock market crashes have played a role in shaping financial regulations, investment strategies, and risk management practices.

- Lessons for Investors: Studying past crashes can provide valuable lessons for investors. It underscores the importance of diversification, risk management, and a long-term investment perspective.

In sum, comprehending stock market crashes is essential for anyone involved in financial markets. These events are not only historical occurrences but also influential forces that continue to shape the investment landscape.

The Great Depression (1929)

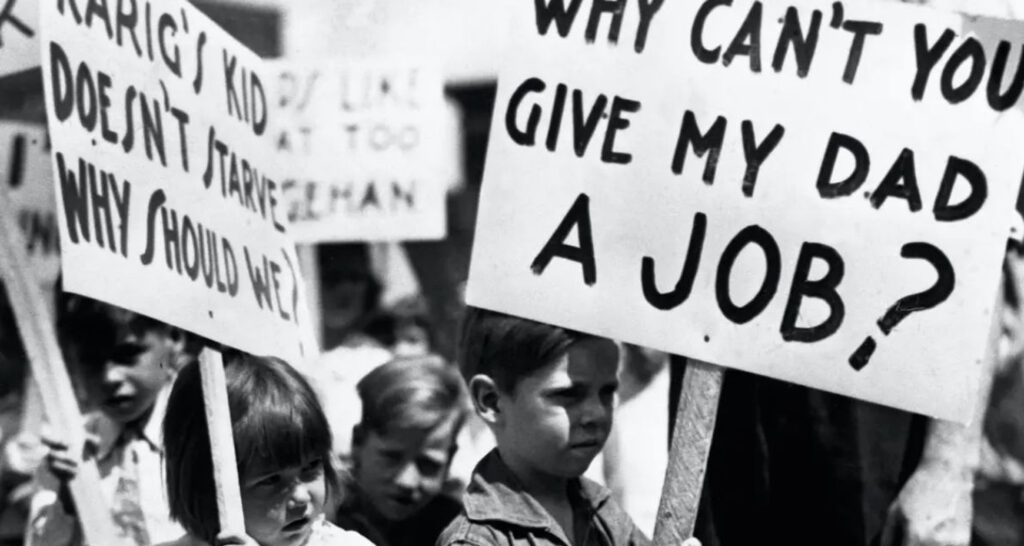

The Great Depression of 1929 is one of the most iconic and devastating economic crashes in history. It had profound causes, consequences, and lessons that continue to shape the world’s economic and financial landscape.

Key insights:

- Causes: The crash was triggered by a stock market collapse in October 1929, but underlying causes included excessive speculation, high levels of consumer debt, and weaknesses in the banking system. These factors combined to create a perfect storm.

- Consequences: The Great Depression led to widespread unemployment, business failures, and a severe contraction of economic activity. It was a global phenomenon that deeply affected people’s lives and livelihoods.

- Lessons Learned: The Great Depression prompted significant changes in financial regulation and government intervention. Key lessons include the importance of effective monetary policy, financial regulation, and government support during economic crises.

- Duration: The Great Depression lasted for over a decade, with the recovery initiated by World War II. It demonstrated the long-term impact a severe economic crisis can have.

- Cultural Impact: The Great Depression left a cultural legacy, influencing literature, art, and music. It’s remembered for the resilience and resourcefulness of the people who lived through it.

The Great Depression of 1929 was a defining moment in economic history, illustrating the catastrophic consequences of financial instability and the enduring importance of government intervention and regulatory safeguards. It remains a compelling case study for economists and policymakers.

Black Monday (1987)

Black Monday, which occurred on October 19, 1987, is often referred to as one of the most significant stock market crashes in history. Here are key details and insights about this event:

- Events Leading Up to Black Monday: The crash was preceded by a period of economic optimism and rising stock prices. However, several factors contributed to the sudden downturn, including concerns about high valuations, rising interest rates, and computerized trading.

- The Crash: Black Monday saw a dramatic market drop, with the Dow Jones Industrial Average plummeting by over 22% in a single day. This remains the largest one-day percentage loss in stock market history. The crash was marked by intense panic selling.

- Global Impact: While the epicenter was Wall Street, the crash had a global impact, affecting stock markets around the world. It highlighted the interconnectedness of global financial markets.

- Response and Recovery: In response to the crash, central banks and regulators intervened to stabilize markets. Over time, the market recovered, but Black Monday left a lasting mark on financial regulation and the use of circuit breakers to halt trading during extreme volatility.

- Lessons Learned: Black Monday serves as a reminder of the potential risks in financial markets, the importance of risk management, and the need for regulatory safeguards.

- 30th Anniversary: The 30th anniversary of Black Monday in 2017 prompted reflections on the event’s enduring legacy and its relevance in modern financial markets.

Black Monday was a historic market crash characterized by its suddenness and severity. It had a profound impact on financial markets and continues to be studied as a key event in the history of finance and investing.

The Dot-Com Bubble (2000)

The Dot-Com Bubble of 2000 was a significant event in the history of technology and finance. Here are key details regarding the burst of the dot-com bubble and its impact:

- Boom and Bust: The late 1990s saw a massive surge in internet-related companies’ stock prices, even for those with little or no profits. Investors were captivated by the promise of the internet’s potential.

- Irrational Exuberance: The bubble was marked by irrational exuberance, with investors pouring money into tech stocks without much consideration for traditional valuation metrics. Many companies went public with Initial Public Offerings (IPOs) and saw their stock prices skyrocket on the first day.

- The Burst: In 2000, the bubble burst as investors began to realize that many of these companies were overvalued and lacked sustainable business models. Stock prices tumbled, leading to significant losses for investors.

- Impact on Tech Industry: The burst of the dot-com bubble had a profound impact on the tech industry. Many internet companies went bankrupt, while others had to reevaluate their business models. However, it also laid the groundwork for the growth of more sustainable internet-based businesses.

- Investor Strategies: The burst of the dot-com bubble reshaped investor strategies. It highlighted the importance of due diligence, sound investment principles, and the need to avoid speculative bubbles. Investors became more cautious and focused on fundamentals.

- Legacy: The dot-com bubble serves as a cautionary tale, reminding us of the dangers of speculative investing and the importance of prudent financial decisions. It also paved the way for the rise of tech giants like Google, Amazon, and Apple, which weathered the storm and became industry leaders.

The Dot-Com Bubble of 2000 was a period of speculative excess and subsequent crash that reshaped the tech industry and investor strategies, leaving behind valuable lessons for both investors and the technology sector.

The 2008 Financial Crisis

The 2008 Financial Crisis was a global economic downturn with profound causes and effects, leading to a recession and eventual recovery. Here’s a brief overview:

Causes:

- Housing Bubble: The crisis was triggered by a housing bubble, fueled by risky mortgage lending and securitization of subprime mortgages.

- Financial Market Complexities: The complexity of financial instruments, including collateralized debt obligations (CDOs) and credit default swaps (CDS), contributed to the crisis.

- Lehman Brothers Bankruptcy: The bankruptcy of Lehman Brothers in September 2008 sent shockwaves through the financial system, eroding confidence.

Effects:

- Recession: The crisis resulted in a severe recession, leading to job losses, falling home values, and economic turmoil.

- Global Impact: The crisis had global ramifications, affecting financial markets worldwide and leading to a synchronized global recession.

- Bank Bailouts: Governments intervened with bank bailouts to stabilize the financial system and prevent a complete collapse.

- Regulatory Changes: The crisis prompted significant regulatory changes, including the Dodd-Frank Wall Street Reform and Consumer Protection Act in the U.S.

Recovery:

- Government Interventions: Central banks implemented monetary policies, and governments introduced stimulus packages to kickstart economic recovery.

- Recovery Timeline: The recovery was gradual, with the U.S. economy taking several years to return to pre-crisis levels.

- Long-Term Impact: The crisis left a lasting impact on investor behavior, risk management, and the financial industry.

The 2008 Financial Crisis was a multifaceted event driven by housing market issues, financial complexities, and the collapse of major institutions. It resulted in a global recession, extensive government interventions, and long-term changes in financial regulations and industry practices.

Understanding Market Recovery After Crashes and Opportunities

Market recovery after crashes is a critical phase in the financial world. Here is how markets recover and the opportunities they offer:

Phases of Recovery:

- Recovery has stages: Markets typically experience an initial bounce, followed by a period of volatility, and then a more stable uptrend.

- Investor psychology: Understanding these phases helps investors stay calm and make informed decisions.

Opportunities During Recovery:

- Discounted Assets: After a crash, many assets are undervalued, presenting buying opportunities.

- Long-term gains: Stocks bought at the right time can yield significant long-term returns.

Diversification:

- Spread risk: Diversifying across different asset classes can minimize risk during turbulent times.

- Balancing act: Rebalancing portfolios as markets recover is essential to maintain the desired asset allocation.

Sector Rotation:

- Changing leadership: Different sectors perform better in various phases of recovery.

- Active management: Adapting to sector rotations can enhance returns.

Cautious Optimism:

- Don’t rush: Avoid impulsive decisions during recovery; patience is key.

- Research: Analyze economic and market factors to make informed choices.

Long-term Perspective:

- Time in the market: Remaining invested over the long term is often more rewarding than timing the market.

- Retirement planning: Market recovery plays a significant role in retirement savings.

Economic Indicators:

- Employment: Job growth is a crucial indicator of economic recovery.

- Interest rates: Lower rates can stimulate economic growth.

Understanding market recovery and the opportunities it provides is essential for investors. It allows them to navigate turbulent times with greater confidence and make decisions that align with their financial goals.

Lessons from Historical Crashes

Historical crashes in financial markets offer valuable insights and lessons for investors. Here are major takeaways from these events and how they can guide investors in making informed decisions:

- Risk Assessment: Historical crashes emphasize the importance of risk assessment. Investors should diversify their portfolios to spread risk and avoid putting all their assets in a single investment.

- Long-Term Perspective: Markets tend to recover over time. Investors should adopt a long-term perspective and avoid making impulsive decisions during market downturns.

- Regulatory Changes: Many market crashes led to regulatory changes that enhance market stability. Staying informed about these changes is crucial for investors.

- Behavioral Finance: Understanding behavioral finance can help investors recognize the impact of emotions on decision-making. Emotional decisions can lead to losses.

- Emergency Funds: Having an emergency fund is essential. It provides a safety net during economic crises, allowing investors to cover living expenses without selling investments at a loss.

- Asset Allocation: Asset allocation is a critical factor in managing risk. Historical crashes underscore the importance of balancing investments in various asset classes.

- Learning from Mistakes: Studying past market crashes helps investors learn from mistakes and adapt strategies to mitigate risks.

- Information is Key: Staying well-informed and conducting thorough research is vital. This includes understanding the assets in one’s portfolio and keeping up with market news.

- Professional Guidance: Seeking advice from financial professionals can provide valuable insights and strategies tailored to individual financial goals.

Historical crashes offer a wealth of lessons, emphasizing the need for risk management, a long-term perspective, knowledge of regulatory changes, and a deep understanding of behavioral finance. Investors who heed these lessons can make more informed decisions and navigate the complexities of financial markets with greater confidence.

The Importance of Risk Management and Diversification in Financial Planning

Risk management and diversification are fundamental principles in financial planning, ensuring the stability and growth of your investments:

1. Risk Management:

- Protection: Risk management aims to protect your investments from potential losses.

- Identify and Assess Risks: It involves identifying different types of risks, such as market risk, credit risk, and operational risk.

- Risk Tolerance: Determine your risk tolerance based on your financial goals, time horizon, and comfort level with potential losses.

- Asset Allocation: Allocate your investments across various asset classes, such as stocks, bonds, and real estate, to manage risk effectively.

- Insurance: Consider insurance products like life, health, or property insurance to mitigate specific risks.

- Emergency Fund: Maintain an emergency fund to cover unexpected expenses and prevent the need to liquidate investments during crises.

2. Diversification:

- Spread Risk: Diversification involves spreading investments across a variety of assets to reduce exposure to a single investment or asset class.

- Minimize Volatility: By owning different types of assets, your portfolio becomes less vulnerable to the volatility of any one market or sector.

- Optimize Returns: Diversification seeks to achieve an optimal balance between risk and return.

- Asset Allocation: Effective asset allocation can be a key strategy to diversify your investments.

- Rebalancing: Regularly review and rebalance your portfolio to maintain the desired diversification.

Risk management helps safeguard your financial well-being by identifying and mitigating potential risks. Diversification minimizes risk by spreading investments, increasing the likelihood of achieving your financial goals. A well-thought-out financial plan combines these strategies to achieve a balance between risk and reward, helping you navigate the complexities of the financial world.

Investment Strategies for Safeguarding Portfolios During Market Downturns

Investors seeking to protect their portfolios during market downturns can employ several strategies:

- Diversification: Spreading investments across various asset classes reduces risk. A mix of stocks, bonds, real estate, and commodities can help weather market turbulence.

- Asset Allocation: Define a suitable asset allocation based on your risk tolerance and investment horizon. Adjust the allocation periodically to maintain balance.

- Defensive Stocks: Invest in defensive stocks from sectors like healthcare, utilities, and consumer staples. These sectors tend to be less volatile during economic downturns.

- Hedging: Consider hedging strategies like put options or inverse exchange-traded funds (ETFs) to protect against market declines.

- Dividend Stocks: Dividend-paying stocks can provide income even when markets are underperforming.

- Fixed-Income Investments: Bonds and Treasury securities offer stability and regular interest payments.

- Cash Reserves: Maintain cash reserves to seize investment opportunities during downturns and cover expenses without selling assets at a loss.

- Robo-Advisors: Utilize robo-advisors for automated portfolio management and rebalancing.

- Long-Term Perspective: Avoid emotional reactions and maintain a long-term perspective. Markets tend to recover over time.

- Continuous Learning: Stay informed about market trends, economic indicators, and investment options to make informed decisions.

- Professional Advice: Consult with financial advisors for personalized strategies that align with your financial goals.

- Regular Reassessment: Review and adjust your investment strategy periodically to adapt to changing market conditions and life circumstances.

It’s crucial to tailor these strategies to your unique financial situation and risk tolerance. Diversification and a well-thought-out asset allocation often form the core of a resilient investment strategy. A combination of defensive stocks, hedging, and fixed-income investments can further enhance portfolio protection during market downturns. Staying informed and maintaining a long-term perspective are essential components of successful investing in all market environments.

The Impact of Psychology and Emotions on Investment Decisions in Market Crashes

Behavioral finance delves into the fascinating realm of human psychology and emotions, shedding light on how these factors profoundly influence investment decisions, especially during market crashes:

Herding Behavior:

- Description: Investors often follow the crowd, even when it defies rationality.

- Impact: During market crashes, herding behavior can lead to panic selling or buying frenzies, exacerbating market volatility.

Loss Aversion:

- Description: People dislike losses more than they enjoy equivalent gains.

- Impact: During a market crash, the fear of further losses may drive investors to sell assets hastily, potentially locking in significant losses.

Overconfidence:

- Description: Investors tend to overestimate their knowledge and abilities.

- Impact: Overconfident investors may hold on to declining assets, hoping for a rebound, and avoid necessary risk-reduction actions.

Anchoring:

- Description: Investors anchor their decisions to irrelevant reference points.

- Impact: During market crashes, anchoring can cause investors to hold onto their investments based on past valuations, even if those valuations are no longer relevant.

Recency Bias:

- Description: Investors give more weight to recent events.

- Impact: In a market crash, recency bias can cause investors to extrapolate current trends into the future, leading to overly pessimistic or optimistic decisions.

Regret Aversion:

- Description: Investors fear regretting their decisions.

- Impact: During market crashes, this can result in inaction, as investors avoid making choices that might lead to later regrets.

Understanding these psychological biases is crucial for investors. It highlights the importance of maintaining a rational and long-term perspective, having a well-thought-out investment strategy, and avoiding impulsive decisions driven by fear, greed, or the desire to conform to the crowd. By recognizing the impact of psychology and emotions, investors can navigate turbulent markets with more resilience and prudence.

Conclusion

In conclusion, understanding the dynamics of market recovery, the significance of risk management, diversification strategies, and the influence of behavioral finance on investment decisions during market crashes is crucial for securing your financial future. By applying these lessons and taking a proactive approach, you can enhance your financial well-being and work towards a more secure financial future.